Low Short Interest Isn’t Bullish, and Gold May Not Be Safe Either

In this week’s report:

Detect stock bubbles (low short interest is NOT a bullish signal)

The real risks for Gold and Bitcoin holdings (physical and ‘digital’ gold aren’t as safe as you might think)

1. Detect stock bubbles (low short interest is NOT a bullish signal)

Optimism Everywhere: Beliefs during Stock Price Bubbles (October 24, 2025) - Link to paper

TLDR

Low short interest during run-ups predicts crashes: When sophisticated investors aren't betting against rallies due to high borrowing costs or consensus optimism, it signals dangerous overvaluation, not validation

Analyst euphoria is a contrarian indicator: Extreme optimism in long-term growth forecasts and expected returns from sell-side analysts reliably precedes 40%+ drawdowns

Actionable framework: Combining high analyst expectations, compressed short interest, and parabolic price action creates quantifiable screens for reducing exposure before crashes

What the authors did

New research from Harvard Business School's Robin Greenwood and Christian Stolborg analyzing over 5,000 boom-bust episodes in US stocks from 1980-2023 reveals a counterintuitive finding: the most dangerous bubbles occur precisely when professional skepticism disappears. For institutional investors, this research offers a quantifiable framework for identifying elevated crash risk before it's too late.

The paper's most striking discovery challenges conventional wisdom about short-selling during manias. During stock price run-ups that precede crashes, short interest is lower, not higher. This paradox reveals that sophisticated investors – the very people who should recognize overvaluation – are either priced out by prohibitive borrowing costs or swept up in the optimism.

When hedge funds aren't betting against a rally, it signals dangerous consensus, not validation.

What they found

The paper's actionable contribution lies in demonstrating that expectation measures can forecast crash probability ex-ante. More optimistic analyst forecasts, combined with lower short interest, predict higher crash risk.

For portfolio construction, this suggests implementing quantitative screens that flag positions where multiple optimism indicators align – high analyst growth expectations, compressed short interest, and parabolic price paths.

The paper studies individual stock crash probabilities for stocks meeting extreme run-up criteria (doubled in price + high valuations).

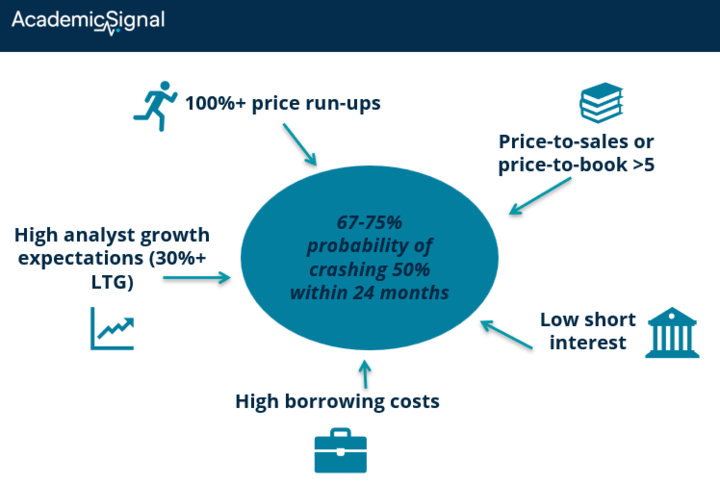

When you see stocks with:

100%+ price run-ups

Price-to-sales or price-to-book > 5

High analyst growth expectations (30%+ LTG)

Low short interest

High borrowing costs

...those stocks have a 67-75% probability of crashing 50%+ within 24 months.

Analysts as lagging indicators

The research documents that analysts exhibit systematically optimistic behavior during bubble periods. Stocks experiencing run-ups show elevated long-term earnings growth forecasts and higher near-term expected returns from sell-side analysts. Rather than serving as skeptical gatekeepers, analysts amplify the bubble narrative.

The authors find limited use of terms like "bubble" or "overvalued" in media coverage during run-ups, and remarkably, even after crashes begin, this language remains scarce.

The implication for active managers: when analyst consensus becomes euphoric and dissenting voices vanish, it's a sell signal, not a buy confirmation.

Real-time implications for professionals

The research validates a critical risk management principle: absence of bears is more concerning than their presence. When borrowing costs remain subdued and short interest low during extended rallies, it indicates insufficient price discovery. Sophisticated investors should view this as a yellow flag for position sizing and liquidity management.

For long-only managers, the findings support reducing exposure to holdings exhibiting bubble characteristics before consensus shifts. The data shows crashes average 40% drawdowns – sufficient to impair annual performance significantly.

For market-neutral strategies, the research suggests caution on short legs during peak euphoria due to prohibitive carry costs; better opportunities emerge after initial cracks when borrowing normalizes.

The paper also reveals an institutional opportunity: securities lending during bubble periods can generate extraordinary returns, though with attendant risks if underlying positions decline sharply while on loan.

The bottom line

Greenwood and Stolborg's research challenges the "bubbles are only obvious in hindsight" narrative. The consistent absence of skeptics – measured through analyst forecasts, short interest, and media sentiment – provides early warning signals.

For professional investors, the takeaway is clear: when everyone agrees and contrarians disappear, it's time to disagree with the crowd. Markets reward those who recognize that optimism everywhere often means trouble ahead.

2. The real risks for Gold and Bitcoin holdings (physical and ‘digital’ gold aren’t as safe as you might think)

Gold and Bitcoin (October 2, 2025) - Link to paper

TLDR

Bitcoin's algorithmic 21 million cap makes it immune to supply inflation, but a 51% attack on Bitcoin would cost only $6 billion (0.26% of network value) and could destroy the entire ecosystem; whereas the quantum threat everyone worries about won't be viable until 2048

Gold faces credible supply shocks from nuclear fusion "alchemy" (2-5 tons/year from 1 GW plants) and near-Earth asteroids containing 62.7 million tons (290x the current above-ground supply)

What the author did

Duke professor Campbell Harvey quantifies the actual risks facing Bitcoin and gold as safe-haven assets, and his findings challenge conventional wisdom.

A 51% attack on Bitcoin is more plausible than the quantum threat

While markets obsess over quantum computing destroying Bitcoin's cryptography, Harvey shows the real threat is far more prosaic and immediate.

A hostile actor could execute a 51% attack – gaining majority control of Bitcoin's mining network – for approximately $6 billion. This includes $4.6 billion in specialized ASIC hardware, $1.34 billion for data center construction, and $130 million in weekly electricity costs. For context, Bitcoin's market cap exceeds $2 trillion, making this attack cost just 0.26% of what it could destroy.

The profit motive is clear: Bitcoin's futures and perpetual markets trade $70 billion daily. An attacker could short the market, execute the attack, and profit massively as Bitcoin crashes (more than covering the $6 billion outlay).

Why the quantum threat is overblown

Harvey's analysis of quantum computing reveals a much longer timeline than feared. Breaking Bitcoin's elliptic curve cryptography requires 8.56 million physical qubits and 2,330 logical qubits. Google's celebrated Willow quantum computer, announced in 2024, has just 105 physical qubits (0.001% of what's needed) and a single logical qubit.

Physical qubits have doubled every two years. At this rate, quantum computers capable of breaking Bitcoin won't exist until 2048, giving the network ample time to implement post-quantum cryptography. NIST already selected CRYSTALS lattice-based cryptography as the quantum-resistant standard in 2022.

The problem is straightforward: Bitcoin users will simply migrate their holdings to quantum-resistant addresses before the threat materializes. The only vulnerable coins are the estimated 1.5 million lost BTC with exposed public keys.

Gold's hidden supply risks

Harvey's most striking finding challenges gold's "naturally scarce" narrative. Near-Earth asteroids contain an estimated 62.7 million tons of gold (that’s 290x the current above-ground supply of 216,265 tons). The closest target, asteroid 1986 DA, holds roughly 100,000 tons (half of all existing gold) and requires only 5.3 km/s delta-v to reach (comparable to a moon mission).

More immediately, nuclear fusion advances threaten gold supply. Marathon Fusion's 2025 research shows a 1 GW fusion reactor could transmute mercury-198 into gold-197, producing 2-5 tons annually. While fusion at this scale remains theoretical, the technological path is clear.

The bottom line

For portfolio allocation, this analysis suggests Bitcoin's supply cap provides genuine scarcity protection that gold lacks, but only if the 51% attack vector gets addressed through increased mining decentralization or protocol changes. Gold's long-term value proposition faces disruption from the same technological progress that has undermined most commodity prices.

The immediate actionable insight: monitor Bitcoin mining pool concentration (currently no pool has >30%, but this changes quarterly) and watch fusion energy development timelines. Both could materially impact the "digital gold" versus gold positioning within 5-10 years, not decades.

For investors treating either as portfolio insurance, Harvey's work suggests neither is as "safe" as conventional wisdom holds but their risks are fundamentally different and potentially complementary.

Disclaimer

This publication is for informational and educational purposes only. It is not investment, legal, tax, or accounting advice, and it is not an offer to buy or sell any security. Investing involves risk, including loss of principal. Past performance does not guarantee future results. Data and opinions are based on sources believed to be reliable, but accuracy and completeness are not guaranteed. You are responsible for your own investment decisions. If you need advice for your situation, consult a qualified professional.